New trend in condo market

Condos, after years of sluggish activity, have suddenly become very active. The condos on Village Hill and Fairway Village in Northampton are going like hotcakes. Why so? I believe it is the new demand from baby boomers who are downsizing from houses to condos. Some are already in the area and some are coming from afar to be near grandchildren and to live in our area, with its cultural stimulation, local food and farms, and outdoor recreation.

The market in general is very much a seller's market, due to the continuing low inventory (see previous blog posts for the reasons for this). So this and the artificially low interest rates (created by the aggressive interventions of the Federal Reserve and the Obama administration into mortgage and debt markets) are preventing house prices from falling to their natural levels. As a result, home prices and land prices in Northampton, for example, are increasingly out of reach for young buyers without the help of their parents.

Though nicer properties are flying off the market, it is not a healthy market because demand is slowly being destroyed by hyperinflation on the one hand and poor job prospects and heavy debt burdens on the other.

All this could, of course, change in a moment if interest rates rise or another black (white?) swan flies. My guess is that the black swan this time could be massive defaults on student loans or a financial collapse of the fracking industry due to the low price of oil.

Industrial wind turbines and Lusitano horses

A land consultant I recommend to clients, Bill Lattrell of Heath, wrote an excellent report on industrial wind turbines. It is so impressive that I feel I have to link it here for interested readers. Bill and his co-author Steve Ryack wrote this report for the town of Heath in 2013, but their conclusions unquestionably still hold.

A few paragraphs particularly jumped out at me:

People complain of a peculiar and particularly debilitating quality to

the sound from turbines. A paper by Thorne in the journal, “Bulletin of

Science and Technology” August 2011, shows that unlike other industrial

noises, the amplitude and frequency of wind turbine noise is

continuously modulated (AM and FM). That is, the pitch and the loudness are not steady but change continuously.

Another example of AM and FM modulation is the sound of a police

cruiser or fire truck. The continuous change of pitch and loudness makes

it very hard for people to become desensitized or habituated to the

sound, as occurs with other industrial sounds. On the contrary,

sensitization over time appears to occur more frequently when pitch and

loudness are modulated. Also, as wave frequency decreases, the

effectiveness of barriers such as walls and windows to attenuate sound

is diminished. Windows and walls are actually induced to vibrate at

lower frequencies. Decreasing wave frequency is the same as increasing

wavelength. As the wavelength approaches the dimensions of rooms and

houses, standing waves are set up within these structures. As the waves

bounce back and forth in these enclosed spaces their amplitude

(loudness) increases, much as the height of a child on a swing increases

each time it is given a push. They become resonant chambers in their

own right, resulting in indoor noise levels higher than those outdoors.

And this one:

The health affects of industrial wind are not limited to those resulting

from acoustic waves. The Committee briefly considered the effect of

seismic vibrations on nearby structures. A moderate size industrial

turbine of 1.5 MW weighs about 160 tons, with seven ton blades rotating

at close to 180 MPH at the periphery. When it is installed on ledge,

massive blasting or other alteration of the ridge top may be required to

anchor it to the ground. The coupling of the turbine to ledge

propagates the vibrations of the structure, generated by the torques of

the rotating blades, to the ground beneath. Any residential structure in

the path of the seismic waves would be exposed to vibration. A home

near the relatively small wind turbine in Charlemont is subject to

internal vibration from the basement up whenever the turbine rotates.

The vibration has been likened to the ground vibration induced by a

device farmers use to eject burrowing animals from their subterranean

abodes.

Which reminds me of a study done in Portugal a few years ago, where Lusitano horses, an ancient breed which has never been shod and so has an abundance of proprioceptive and graviceptive sensors in their feet, were living in the vicinity of a newly built wind farm. The younger horses developed some major flexural deformities of their feet within six months of the wind farm becoming operational, and even unrelated foals, brought to the stud farm from elsewhere, developed a similar deformity after 6 months.

According to the author of the study, Teresa Margarida Pereira Costa e Curto:

The flexural deformities have a complex and multifactorial etiopathogeny. They occur due to uncoupling of the longitudinal development of the bone and its adjacent soft tissues, but also from shortening of the tendon-muscle unit in response to pain.

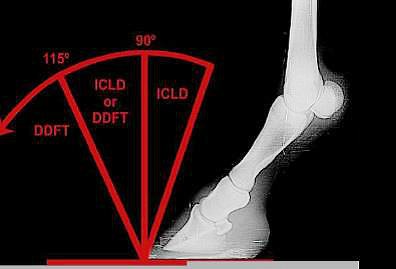

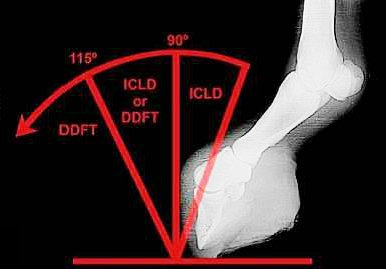

Radiological examination of front limbs, before and after

The clubbed mass of the deformed foot and its tiptoe-like poise are clear in this X-ray. The foal is obviously crippled as a result.

There is a growing deeper understanding, among vets and farriers and in the equine world in general, that the unshod horse is healthier in every respect: the fore limbs are warmer and more richly vascularized; better able to feel the variations of the terrain and to adjust instantly throughout the musculature of the body; and even cardiovascularly more healthy than the shod horse, which is cut off from its environment to some extent and more liable to injury and disease.

Here in these Lusitano foals, the unnatural ground vibration (created by massive wind towers anchored in the underlying bedrock) has apparently overloaded the sensors in the frog of the hoof, the fleshy part where all the sensors are located. So the foal's instinct is to tense up the foot and to stand tiptoed. This constant tension has remodeled both the smooth muscles of the fore limb (with myofibrils reorienting in the direction of this tension) and the bone itself (with osteoblasts remodeling the bone structure in alignment with this tension). It is rather like an autistic child who walks barefoot to avoid the sensory overload from the sensors in the plantar surface of the foot. Only in the case of our foals, the reactive shrinking and tension has deformed them irreparably.

See the entire article on the website for Wind Turbine Syndrome by Nina Pierpont and excerpts from the study here.

Our cells and bones respond to gravity and mechanical stress of all kinds. They change shape and this has all kinds of cascading effects. D'Arcy Wentworth Thompson over a century ago spoke of how animal form remodels itself dynamically in response to gravity and muscular tension. More recently, Donald Ingbar has done some marvellous work on tensegrity in the fascia and the squigy cytoskeleton of the cells (showing how mechanical stresses are converted to biochemical changes). It is an exciting new field in biology, and it is virtually exploding with studies and new discoveries. It may be a decade or two, though, before the mass media catches wind of it.

But for now we are faced with the tragic effects of these massive infrasonic turbines on these beautiful foals, where a 90 ft wind turbine tower would have no such effects at all. And we haven't even touched on the effects they have on the vestibular organs and spatial intelligence of our children. That is a story for another day.

What would a right-brained economy look like?

At first glance, I would expect it to be something along the lines of Ivan Illich's convivial society, with small walkable cities, vibrant regional economies, tools that dovetail with the body and senses (rather than abstracting us from the body), a large freedom and autonomy from distant rulers and corporations, a sensitive relationship to the natural world, and a deep societal aversion to structural violence or poverty.

Sounds idyllic, no? Surely, it would be self-regulating and self-organizing too? Suffering perhaps a minimal state apparatus that is kept on a short leash?

But let's back up a bit. Early states were formed with two ingredients: a massing or concentration of human subjects, by force or slavery if necessary; and an ample food supply, usually rice or wheat or other easily stored grains. See James C. Scott's The Art of Not Being Governed: An Anarchist History of Upland Southeast Asia, where over and over little "civilizations" or city-states appeared in premodern Malaysia as soon as these ingredients came together. The driving force, however, of this "self-organization" was a dopaminergic exploitation of others for their muscle energy as soldiers or laborers or rice farmers, and the stored energy of the rice itself. This ant-hill pattern hasn't changed much to this day, though the energy takes different forms (fossil fuels freed the slaves in a sense) and money and debt are now ubiquitous.

Yet if we look at attachment psychologists like John Bowlby and Daniel Stern and Allan Schore, we see a very different source of energy driving self-organization, and it is this that we must look to for a right-brained economics. The resonance of the mother with the child's emotions, especially positive emotions, energizes the child, sends it into a higher orbit of joy and excitement. And this energy, according to Allan Schore, causes the energy dynamos of the brain cells, the mitochondria, to proliferate madly, bringing more and more energy into the growing brain, and enabling more complex structures to form, some of them regulatory (see Schore, "Early Organization of the Nonlinear Right Brain"). This is self-organization of an entirely different order, and the energy we receive from others all our lives and from culture and music and books and ideas, enables us to reach our full potential as thinking, feeling humans.

So a few random thoughts, a bit pie-in-the-sky to be sure:

- John Bowlby, working with teenage delinquents, had the brilliant intuition that these deprived boys were "stealing love" when they were snatching purses or other material goods. Deprived of early maternal nurture as children, these small boys grew up to be the nearly sociopathic, affection-less juvenile thieves that Bowlby studied after the war. The link between being nourished (with food, or money) and being nurtured (with love) runs deep in us.

- Fossil fuels made the clanking, hissing machines and factories of the Industrial Revolution possible. And the brutalization of men. And mass manufacturing, which drove the old craftsmen out of work. Am not being nostalgic for those days now, but let's think a bit out of the box here: How we might have a very different society if we weaned ourselves from fossil fuels or if they were used minimally.

- If we impress on ourselves the importance of this nurture or nourishment of any child or adult, and how their growth into complexity and self-regulation and sensitivity and intelligence will enrich our world both materially and culturally, shouldn't every effort be made to use our social wealth to foster this?

- Have we not learnt from our recent experience with quantitative easing of the money supply (which basically created money and gave it to the banks, in a misguided effort to stimulate the economy), that we can create sovereign credit, money created by the state, not loaned into existence by banks? Imagine, then, if this sovereign credit were used to create a basic income for every man, woman and child, using our social wealth (which is the real sense of the money supply) to create a more intelligent, more sensitive, and more creative people.

- What about quantitative easing for the people? John Muellbauer, an economics professor at Oxford University, recommends exactly this. See also James Hughes of Trinity College in Connecticut on how the anti-austerity movements in Europe are a harbinger of deep social change and of an end to commodified labor. A basic income guarantee, first broached by Tom Paine in the 18th century, is an idea whose time has come, supported now even by the likes of Milton Friedman. See the website Basic Income Earth Network for the exciting work being done around the world to make a guaranteed basic income a reality. And check out this excellent Belgian documentary on the Basic Income (with English subtitles).

- Most studies suggest that people will still be motivated to work even with such a basic income. The reason for this is our dopaminergic brain loves to have goals and to exercise its intelligence. So when children and young adults are well provided for, they will, I believe, take keen interests in the world and life and seek to discover, to create, whether it be making furniture or farming or puzzling over some fascinating technical problem. So even as some of our most eccentric geniuses have come from comfortable families or aristocratic families in the past, I think we would see a flourishing artisanal economy evolve in the place of our capitalistic megamachine with its mass manufacturing and mass-mediated culture.

- Modern Money Theory, developed by a very interesting group of economists at the University of Missouri at Kansas City, explores this idea of sovereign credit and its feasibility. One concern I have about these folks is that they are, like most economists, still wedded to the idea of endless growth and to the idea that mass manufacturing is a criticial piece of this. Having said that, though, these economists, Michael Hudson, Bill Black, Randall Wray and others, are always on the right side, in my opinion, of the economic issues besetting us today. But, at the end of the day, they are still limited by the old socioeconomic worldview. Update April 20, 2015: Iceland has proposed a revolutionary new finance system, taking the creation of money away from the banks. See this article and the accompanying 110-page white paper commissioned by the Prime Minister of Iceland.

- A ubiquitous feature of … self-organizing systems is that they are stabilized by feedback mechanisms. -- Lee Smolin, Time Reborn (2013), p. 219. And the feedback mechanisms are usually a balancing of opposites, such as emotional expansion/arousal and withdrawal and conservation (see Schore, "Early Organization of the Nonlinear Right Brain," and his book Affect Regulation and the Origin of the Self: The Neurobiology of Emotional Development). Without this balancing, serious developmental disorders are inevitable (e.g., in sociopsychology, the unchecked emotional expansiveness of narcissism). In the economy too, excessive expansion can lead to imbalances of all kinds. Michael Pettis, a brilliant and out-of-the-box economic analyst, speaks of how poverty and inequality and excessive wealth (concentrated in one nation or a small elite), create malinvestment, overproduction, speculation, unsustainable debt, and a fatal deterioration of a country's economy (see his book The Great Rebalancing or his brilliant essay on the Greek debt morass, "Syriza and the French Indemnity of 1871-73"). He of course is focused on "sustainable growth" (probably an oxymoron, at least in today's fossil-fuel-driven economy), but the same ideas could be applied to our new paradigm of individual development toward complexity and self-regulation (and intelligence). It seems in the natural order of things that our entire society should prosper. And a sensitive regulation of the money supply is critical to this fair distribution of our social wealth and a rebalancing of the economy.

- In an ecosystem or an economy, imbalances and a failure of self-regulation create stress, which in turn leads to regression to earlier, less efficient modes of self-organization (see Into the Cool: Energy Flow, Thermodynamics and Life, by Eric Schneider and Dorion Sagan, p. 208). The authors speak of ecosystems regressing under stress, where the ecosystem is then dominated by faster-growing, less evolved species, and where the interconnected harmony and energy flow of the ecosystem is fatally impaired. But self-regulation can often neutralize environmental stressors. A simple example of this self-regulation is a tree that down-regulates its photosynthesis, metabolism, and transpiration when water in the soil diminishes (Into the Cool, p. 223). Seems an object lesson that even a small child can understand.

Let's close here by circling back to Allan Schore and developmental neuropsychology, to that first relationship of neuroemotional resonance with the mother, which (1) amplifies positive affect in both baby and mother, and (2) whose energy flow enables the development of complex, self-regulating structures in the body and brain of the infant. Yet "nonoptimal environments do not supply sufficient quantities of nutritive matter and modulated energy to the growing brain" (Schore, "The Nonlinear Right Brain") and are the source of endless psychobiological disorders and diseases. So it is with the larger society. We must create an optimal environment, both nurturing and self-regulating, for the intelligent, richly creative, and thriving human economy of the future.

Japan's new de-growth

Well, it seems that the scorn being heaped on Japan, "the sick man of Asia," by Western economic analysts may be ignorant and short-sighted. In ways that defy the usual economic measurements and statistics, quality of life has improved immensely during the long stagnation of the Japanese economy, according to an article by Roland Kelts, "Turning Japanese: Coping with Stasis: How the Supposed 'Sick Man of Asia' Might Be a Model for Us All."

Young people are returning to rural areas, and small agriculture-related start-ups are proliferating. True to the ancient Japanese genius, there is a new focus on the small, the finite, the local. People are making do with less and are happier for it. Of course, the Japanese government is still frantic in its efforts to rekindle growth with quantitative easing and aggressive interventions in the financial markets, but the country itself, especially the younger generation, is quietly, even enthusiastically, opting for de-growth.

Members of Girls Farm, based in Japan’s Yamagata Prefecture, are changing the image of agriculture. Credit: Girls Farm

Tiny Homes

Tom Ashbrook's NPR radio show On Point had a very stimulating show yesterday on Tiny Houses and Micro-Apartments: http://onpoint.wbur.org/2015/03/04/tiny-houses-micro-apartments

I was pleasantly surprised that the show covered the subject in such a broad, stimulating manner.

A few thoughts (not covered in the show):

- This tiny house movement, like homelessness, is basically driven by the exorbitant cost of housing and land. In the case of the homeless, it is a shrinking of the home, or one's personal space, to a cardboard box or any makeshift shelter.

- The Millennial generation is pushing back at the debt they are being burdened with, both in student loans and house mortgages. They know they are becoming debt slaves and are thinking creatively of ways to avoid this.

- The guests on the show took care to distance themselves from the clustered makeshift housing in shanty-towns in the Third World (see Mike Davis, Planet of Slums). But isn't this one possible direction this trend could take? Think of the Hoovervilles of the Depression.

- Another form of this effort to wriggle out from beneath the jackboot of the banks by reducing the cost of houses is the use of shipping containers as houses (see http://www.nakedcapitalism.com/2015/02/home-sweet-shipping-container-not.html).

- Yet another form, more dystopian and counterintuitive in that it needs to be highly capitalized, is 3D printing of houses (usually with concrete). But labor-saving is not the issue here, when we have folks willing to build their own homes. The issue is the financialization of housing and land, and the hyperinflation this has created. The same happened with higher education with student loans driving up college costs. Debt is the real villain of this piece and we can see its effects in all the costs of modern life.

- Probably the extreme of micro-apartments are the cage or coffin apartments of Hong Kong, which the poor and unemployed are condemned to live in, while the Hong Kong rich lives in mansions:

Cheung Kam Chu, 49, lies in his ‘coffin’. Below him is Wong Chi Hung. Copyright: Brian Cassey. See the full article and more photos in the Globe and Mail.

- Such is the end result of runaway asset inflation in Hong Kong. Perhaps a cautionary tale about the trends in our own society?

- These houses are for singles really, even the more appealing tiny houses highlighted by the show. Not for families or for domestic pets or even, in many cases, for folks who would like to garden or have a deeper connection with the land and Nature and farm animals.

- Yet I was deeply stimulated by all this. Even heard a very interesting eulogy for the Millennial generation (long overdue), saying that they are more introspective, more aware of themselves and the forces in the world around them, whether it be global warming or the crushing burden of debt, or the foods that they eat. Or, for that matter, the houses they live in. Indeed, everything is being re-thought, re-assessed. It is a wonderful creative time, though probably totally confusing and frightening for most individual Millennials.

Deeper issues behind the Kinder Morgan pipeline

Geopolitics, peak oil, and the global collapse of debt expansion are intersecting right here in Western Massachusetts, with the large, high-pressure pipeline Kinder Morgan proposes to build to transmit hydrofracked natural gas from the Marcellus Shale to the east coast.

Most activists opposing the pipeline are focused more on the destruction of farmland and rural beauty locally, and the impact on the health and quality of life in towns that this pipeline could run through. To be sure, they are also fighting in sympathy with folks in Ohio and elsewhere who have had their water aquifers contaminated by the fracking that produces the gas (not to speak of the earthquakes and other environmental degradations). What's more, they are resisting vigorously any corporation (or government) that seeks to ride roughshod over their lives.

However, I seriously doubt this pipeline will ever materialize. Not so much because of the resistance to it (though that is very healthy and the best thing about this whole affair), but because the growth of debt expansion has reached its limit. You need income to service debt, and wages and real profits have been falling steadily all over the world (as finance and debt hollow out the real economy). So without the false growth or the false income of debt to bouy demand for natural gas or oil or other commodies, we are now seeing a slow collapse of oil and gas prices. This will soon impact production, especially the fracking operations in the Marcellus Shale, where they need high gas prices to survive as businesses. Most of that shale gas will probably stay in the ground or be too expensive to extract at the current market price. See Gail Tverberg on this. She calls this "peak oil due to demand collapse" (and eventually production collapse due to low prices). The oil and gas will stay in the ground, at least in places that require a highly expensive extraction process, such as the Tar Sands of Alberta or the Marcellus Shale.

This pipeline, like most pipelines across the globe, has geopolitical ramifications as well. In opposing the South Stream (now diverted to Turkey) or the Iran-Iraq-Syria pipelines from Russia and Iran respectively, the Obama administration has assured Europe (without any basis) that the US can supply its demand for natural gas with liquified natural gas (LNG) shipped in highly specialized vessels to Europe. It is expected by Kinder Morgan that much of the gas transmitted by this pipeline through Western Massachusetts will go to yet-to-be-built LNG facilities in Atlantic Canada (four of them) and Maine (one). These facilities will be the final terminus of the pipeline and much of the gas will be shipped to Europe. So this pipeline is also part of the Great Game (a bit too grandiose of a name, considering the incompetence with which the Americans are playing the game) of petropolitics. Indeed, the effort to regime-change Assad in Syria was first triggered by his favoring the Iran pipeline over a Qatari pipeline. We needed a more compliant head of state there.

So this pipeline is fraught with meaning and menace for those who look a bit deeper into the forces pressing for its completion.

Why FHA loans are not all they're cracked up to be

The gist of the following article is that FHA loans were an effort by the Federal government to reinflate the real estate market with low-interest-rate, government-subsidized loans. This plan has backfired disastrously with massive defaults that have driven up mortgage insurance costs, forcing the Feds to add on charges. So the loans have in effect become very expensive indeed.

Also some interesting thoughts about the lack of a stop-loss in real estate when prices begin to free-fall. And an interesting paragraph with advice to buyers who may need to sell or move within 5 years.

Here is it, from the OC [Orange County, California] Housing News website:

High loan costs cause FHA originations to plunge

FHA loan originations are plunging because high borrowing costs turn off potential buyers, and risks of put-backs make lenders reluctant.

The biggest barrier to first-time homebuyers is saving for a down payment. As a result, most first-time homebuyers turn to the FHA because the FHA only requires 3.5% down, but as everyone who’s gone down that road also quickly learns, FHA financing is expensive; in fact, FHA financing is so expensive, it’s like taking out a 12.4% second mortgage!

Many have quipped that FHA has become the replacement for subprime. They have very low standards for qualification (a 580 FICO score), a very low down payment requirement (currently 3.5%), and as a result, they stepped into the void left by the collapse of subprime lending.

Under direction from politicians to save the housing market, the FHA ignored the real cost of mortgage risk for years as house prices collapsed, and as a result, they face a government bailout. As the losses mount, reality set in at the FHA, and they continually raise the cost of their insurance to cover the losses from their bad loans. This increased insurance cost adds to a borrowers cost of financing, and it serves as a proxy for raising interest rates on borrowers using FHA financing.

The FHA insurance premium is a direct measure of repayment risk divorced from interest rates. Ordinarily, this risk is rolled up into the interest rate, which is why subprime loans used to carry a higher rate. However, FHA loans have the same interest rate as prime customers. Since the FHA insurance premium is an added borrower cost, with a little math, we can calculate the effective interest rate on an FHA loan and see the incremental cost of that last 16.5% of the mortgage is about a 12% interest rate.

The high cost of FHA financing is one of the many reasons first-time homebuying participation is near record lows. And since these high FHA fees are necessary to properly price risk and make the FHA solvent, unless Congress wants to massively bail out the FHA, the fees will stay high for the foreseeable future.

FHA Loans Plunge 19% as Lenders Haggle With Officials

By Alexis Leondis Sep 19, 2014 12:00 AM PT

… Federal Housing Administration loans, given to borrowers with weaker credit scores and requiring small down payments, plummeted 19 percent in the nine months ending June 30 compared with a year earlier. …

A big part of this drop was expected as refinance volume dried up, but purchase originations are down significantly as well.

The largest U.S. home lenders are curtailing FHA mortgages because of concerns that they will be penalized for what they consider immaterial underwriting errors when loans default.

JPMorgan Chase & Co. (JPM), Bank of America Corp. and other lenders have paid more than $3 billion in fines for originating faulty FHA loans during the housing bubble following lawsuits brought by the Department of Justice and state attorneys general. Julian Castro, secretary of the Department of Housing and Urban Development that oversees FHA, said the agency wants to ease credit by rewriting its handbook to clearly spell out when lenders can be forced to bear the cost of soured loans.

“A big issue is the DOJ settlements and their impact on the lending attitudes of the banks, which is clearly the elephant in the room,” said Brian Chappelle, a former FHA official and partner at Potomac Partners LLC, a consulting firm for lenders in Washington. “The government is worried about access to credit. They’re looking at volume numbers and they know it’s a serious problem.”

Fighting over put-backs will go on for years. Lenders want to originate as much as possible to generate fees, and the fear of loss from put-backs is the only check-and-balance in the system to prevent them from lowering standards to zero like they did during the housing bubble.

The more stringent the put-back rules, the less risk of loss the US taxpayer absorbs, but the fewer loans lenders originate. I anticipate there will be some relaxation of these rules in the next few years, but with the huge financial problems facing the FHA, these rules won’t loosen too much, and in the grand scheme of things, Congress would rather see the market share of FHA dwindle and help private lending take up the slack.

FHA insured 420,709 purchase loans in the nine months through June 30, compared with 516,588 mortgages during the same period a year earlier, according to HUD data. A record 1.1 million loans were backed by FHA in the 12 months ending Sept. 30, 2010. The annual average for the prior 10 years was 589,242. …

So based on those numbers, the FHA is originating the same number of loans as they averaged during the previous 10 years. What’s the problem here? If loan origination volume is the issue, then private lenders need to increase their activity, either through portfolio lending or securitization.

Defaults on these mortgages led to losses that forced the FHA to take a $1.7 billion taxpayer bailout last year — the first in its 80-year history.

This is why standards won’t loosen much.

In 2013, 39 percent of first-time buyers used FHA loans, which generally require 3.5 percent down, compared with 56 percent in 2010, according to data from the National Association of Realtors.

“Access to credit is tightening across the board and the number of people who can get a home is shrinking to the point of code red,” said Anthony Hsieh, CEO of LoanDepot.com, the third largest FHA lender.

Bullshit, Despite industry spin, mortgage lending standards are not tight.

A dearth of first-time buyers is pushing down the national homeownership rate, which fell in the second quarter to its lowest level since 1995, according to Census Bureau data.

(See: Home ownership rate hits new lows)

Higher FHA mortgage insurance premiums are also depressing demand for its loans and the ability of homebuyers to qualify for them. Borrowers must now pay an up-front fee of 1.75 percent of the loan balance and up to 1.35 percentage points in annual mortgage-insurance premiums.

If FHA’s financial report, which will be released later this year, shows the insurer is in better fiscal health, there will be pressure to reduce premiums, said Lawrence Yun, chief economist at NAR.

There will be pressure, but it will be largely ignored.

“There hasn’t been anything like this weak recovery we’ve had over the last five years, …” Weicher said.

It wouldn’t have been so weak if we had purged the bad debts and hit the reset button. Boomerang buyers would be more active and first-time buyers would also be more excited about real estate if prices were back at 2012 levels. But the banks needed to preserve their solvency, so the powers-that-be reflated the housing bubble, and now they feign surprise that buyers aren’t thrilled about paying sky-high prices. Idiots.

Despite the high costs of FHA financing, for those with no moral compunction against strategic default and passing losses on to their taxpaying neighbors, FHA financing offers some unique benefits.

FHA loans as a stoploss

Back in 2006 when I started publicly warning people not to buy homes due to the impending crash, I pointed out to people that there is no stoploss protection in event of a major decline in prices. Leverage works both ways, and the people who were making huge money on small investments were enjoying stellar returns. However, if prices go the other way, the losses are even more brutal.

Another commonly leveraged investment is stocks. People in a margin account can buy twice as much stock as they can afford by borrowing money from their broker. In the event stock prices collapse, the broker will close out an investor’s position before the account goes negative to preserve their original loan capital. There is no such stoploss protection in residential real estate. If house prices go down, people lose money until prices stop going down. They can easily lose many times their original down payment investment.

Well, at least that used to be true…

Now in an era of short sales as an entitlement, borrowers and speculators have no downside risk beyond their initial down payment. If values go down, people simply petition for a short sale, and the lender absorbs the loss. And when that loan is an FHA loan, the lender simply passes the loss on to the US taxpayer.

The incentive here is clear. Everyone should put the minimum possible down payment on a property to minimize their own exposure. If prices go down, they can petition for a loan modification, a short sale, or simply strategically default with no financial repercussions.

The cost of an FHA loan can be viewed as stoploss insurance, particularly in an non-recourse state like California that has notoriously volatile house prices.

FHA loans as a tool to maximize return on investment

There is a strong secondary incentive to put the minimum down when buying real estate. When you calculate return on investment, the denominator is your investment. The smaller this number is, the higher the return. A 3.5% down payment provides six times the return of a 20% down payment. It’s not the great deal zero-down speculators had going during the bubble, but it’s not bad.

FHA loans are best if you might have to move

Shevy and I always tell people they should rent rather than buy if they think they might need to move in three to five years. Our reasoning is simple, since commissions and closing costs are about 8% of the sales price, it takes at least two years if not longer for houses to appreciate enough to get back the down payment. If a buyer needs to move during that time, their down payment is at risk. This is true irrespective of the financing used, but why should a buyer risk their own money when the FHA will assume more than half this risk for them? Given the uncertainties about future home prices, and the potential to need to move, a buyer is well served by passing off as much risk as possible to the FHA and the US taxpayer.

Personally, I probably won’t follow the advice given above. I didn’t create the awful incentives in the system, I just note them and let others decide how they should behave. There are many ways to rationalize passing speculative losses on to the FHA, and it’s not nearly as difficult to rationalize as stealing a house.

Source: http://ochousingnews.com/blog/high-loan-costs-cause-fha-originations-plunge/#ixzz3F0LQX4O8

Interesting article on the trend away from home ownership

Is current housing weakness a fundamental shift away from home ownership?

Housing sector weakness may be a sign of a change in attitudes away from home ownership as defining the American Dream.

When house prices crashed in 2008, we had an opportunity to usher in a new era of affordable housing with a lower percentage of income devoted to housing in the United States. With less income going toward housing, more income is freed up to spend on other goods and services, stimulating the economy in a sustainable way.

However, that isn’t what politicians decided to do. No, they decided to bail out the banks with a plethora of bailouts aimed at supporting the banks and the loanowners who owed them money. If we had purged the excessive debts created during the housing-credit bubble through foreclosure and recycling the homes, we would be enjoying low, affordable house prices and a strongly growing economy. Instead, we have a weak economy and a weak housing market.

Houses are as expensive as current income levels can push them at near record low interest rates. Housing is weak because job and wage growth is weak, and marginal buyers are getting priced out. It’s really not more complicated than that. And since buyers are now forced to pay the maximum amount their incomes can afford, less disposable income is available to spend on goods and services, weakening the economy.

In short, housing and the economy are weak because we continue to divert excessive amounts of money to the banks. Does the federal reserve recognize this? Of course not; to do so would be tantamount to treason to the member banks that own the federal reserve. We are still paying for the bailouts of lenders and loanowners with a weak economy and high-priced housing.

Fed minutes outline the different reasons housing has been sluggish

July 9, 2014, 3:20 PM ET

Higher house prices and higher interest rates priced out marginal buyers and hedge funds, so since June of 2013, home sales fell, and they will continue to be weak for the foreseeable future.

The housing market has been hit by factors ranging from tough credit standards to burdensome student loans to a lean supply of properties on the market, according to minutes released Wednesday from a recent Federal Reserve meeting.

Closings for new and existing homes had a rough first quarter, prompting Wall Street analysts to lower their annual sales forecast for 2014. Prominent economists had been expecting low mortgage rates to support home sales. But cheap loans haven’t been enough to overcome the below factors discussed by Fed officials in June, according to the minutes.

Prominent economists were looking at the market through rose colored glasses and succumb to their optimism bias and hoping for the best. It was obvious to anyone who looked with objectivity that house sales would be weaker as high prices drove hedge funds from the market. Prices were not pushed higher by surging demand from owner-occupants — the only way housing markets achieve the elusive “escape velocity” economists where hoping for, so when the investor demand left, owner-occupant demand did not take its place. Until the economy creates large numbers of high-paying jobs, which is the real problem they don’t mention, we won’t have strong housing demand.

- Tough credit standards

Credit standards are not tough; they are prudent. Lenders are not giving Ponzis and deadbeats loans; we tried that once, and it didn’t work out very well.

- High down payments

High compared to what? The FHA will give nearly anyone a 3.5% down loan for amounts far in excess of the GSE conforming limit. Apparently, even 3.5% down is too much with how high house prices are.

- Weak demand from young families, driven by burdensome student loans

(See: Most Millennials won’t qualify for a mortgage until 2019)

- Lot shortages

- A low supply of “desirable” homes on the market

This is a direct result of lender’s policies to restrict inventory through delaying foreclosures with loan modifications and denying short sales. They could fix this problem today by simply changing their policies.

- The pool of foreclosures and other distressed properties

If by this them mean there is not near enough foreclosures and distressed properties on the market, then they are right; unfortunately, I think they mean there are too many foreclosures and distressed sales, which is the opposite of what’s true.

If there were more of these properties on the market, we wouldn’t have lot shortages or a low supply of homes. Investment funds would buy some, and flippers would buy some, improve the properties, and put more desirable inventory on the market. Flippers who add value through property improvement can’t do their work if no distressed properties are available for them to renovate and make more desirable.

- Rising construction costs

Rising construction costs are not due to high demand for construction materials. New home construction is still in the doldrums. If prices are higher, it’s entirely due to federal reserve policies inflating all prices. Much of the speculative money floating around is going into commodities and driving up builder costs.

And then there’s this potential biggie: “The possibility that more persistent structural changes in housing demand associated with an aging population and evolving lifestyle preferences were boosting demand for multifamily units at the expense of single-family homes.”

The real question is whether or not home ownership is still the American Dream. I’ve documented in many posts the issues holding back demand (See: Most Millennials won’t qualify for a mortgage until 2019, Imprudent student debt debilitates Millennial home shoppers, and Typical sources of housing demand largely absent)

The days of fog-a-mirror and get-a-loan are gone for good. The bigger question is whether or not the structural problems and adjustments are merely delaying the inevitable, or if there is a grass-roots shift in attitudes toward home ownership. I do believe the current generation won’t have the unbridled enthusiasm of the previous generation — thankfully — and they will be more cautious about buying, which is a natural reaction to the carnage they witnessed, but ownership is primal, and no matter how bad lenders and government officials screw everything up, people will still want to own if it’s advantageous for them to do so, and probably even if it’s not.

With high prices and little prospect for the above-average appreciation the Baby Boomers experienced, owning a home isn’t a “must” like it was 30 years ago, so Millennials don’t feel much urgency. Also, with realtor credibility at less than zero, Millennials aren’t as easily duped by fantasies of boundless appreciation as previous generations either.

The American Dream is not dead. The idea of owning a home will rise from the ashes, and the American Dream will once again include owning the roof over your head and the floor beneath your feet. Personally, I would like to see a return to the traditional view of the American Dream: truly owning a home free of any debt. That’s where peace-of-mind reunites with the American Dream.

Forecasting this year's real estate market

A few clients have asked how this year's market is shaping up. Well, I'm afraid it doesn't look promising. I expect inventory to be low again (though investors seem to have exited the market), mostly because of the large number of potential sellers who are underwater on their mortgage, due to buying too high or borrowing too much (home equity loans). So that means less supply. Also houses are more expensive this year, not because they have risen in price but because mortgage rates have risen 100 basis points (one percent) since last year and this has increased the monthly payment for the same house by 20 percent. So this too will shrink the pool of potential buyers (in fact, entry-level buyers are at their lowest level in a generation based on mortgage originations).

Like the larger economy, which no amount of quantitative easing will kickstart because wages are too low and debt burdens are too heavy, real estate is in a stalmate because of low demand. This will not change until incomes go up. We can no longer fudge over this with easy debt, as we're tapped out, especially the younger generation, with student loan debt (another debt bubble created by misguided government-backed loan programs that have enriched the banks, sent college costs sky-high, and impoverished a generation), not to speak of low wages, poor career prospects, and high rents.

This has definitely put a damper on the demand side too. So with both supply and demand down, we'll have a very slow real estate season this year. Nicer houses that are reasonably priced will fly off the market, perhaps with multiple bids in Northampton. Indeed, buyers who are determined to get a place of their own will have to be quick on their feet.

A bit of humor

A client wanted to see a house on Hobart Lane in Amherst, a notorious party street for UMass students. Did some research on an Amherst blog that focuses in part on nuisance rental houses in Amherst and found this telltale photo:

Not a good sign when the Hobart Lane street sign is replaced with a beer can.